But I must explain to you how all this mistaken idea of denouncing pleasure and praising pain was born and will give you a complete account of the system and expound the actual teachings of the great explore

Contact Us

In light of the projected manpower requirement of the BFSI (Banking, Financial Services, and Insurance) labor force reaching 8.5 million by 2022—an increase of approximately 4 to 4.5 million from the present—there is a recognized urgency within the industry to address skill development. Industry leaders agree that enhancing skills is imperative for sustained growth and to solidify the BFSI sector's pivotal role in the Indian economy.

The BFSI Skill Development Program is meticulously crafted to empower young graduates and 12th Pass students aspiring to embark on a rewarding career in the banking and finance sector. This initiative offers a placement-linked training program designed not only to equip youths for their career journey but also to unearth potential avenues of employability through dedicated Career and Job Fairs.

Our program aims to:

Support economically disadvantaged youth in building successful careers within the BFSI sector.

Provide accessible skill training to local youths, tailored to meet localized demands.

Empower youths with essential employability skills within the BFSI domain, fostering financial independence.

Cultivate confidence, interview prowess, and presentation skills through comprehensive Job-Readiness training.

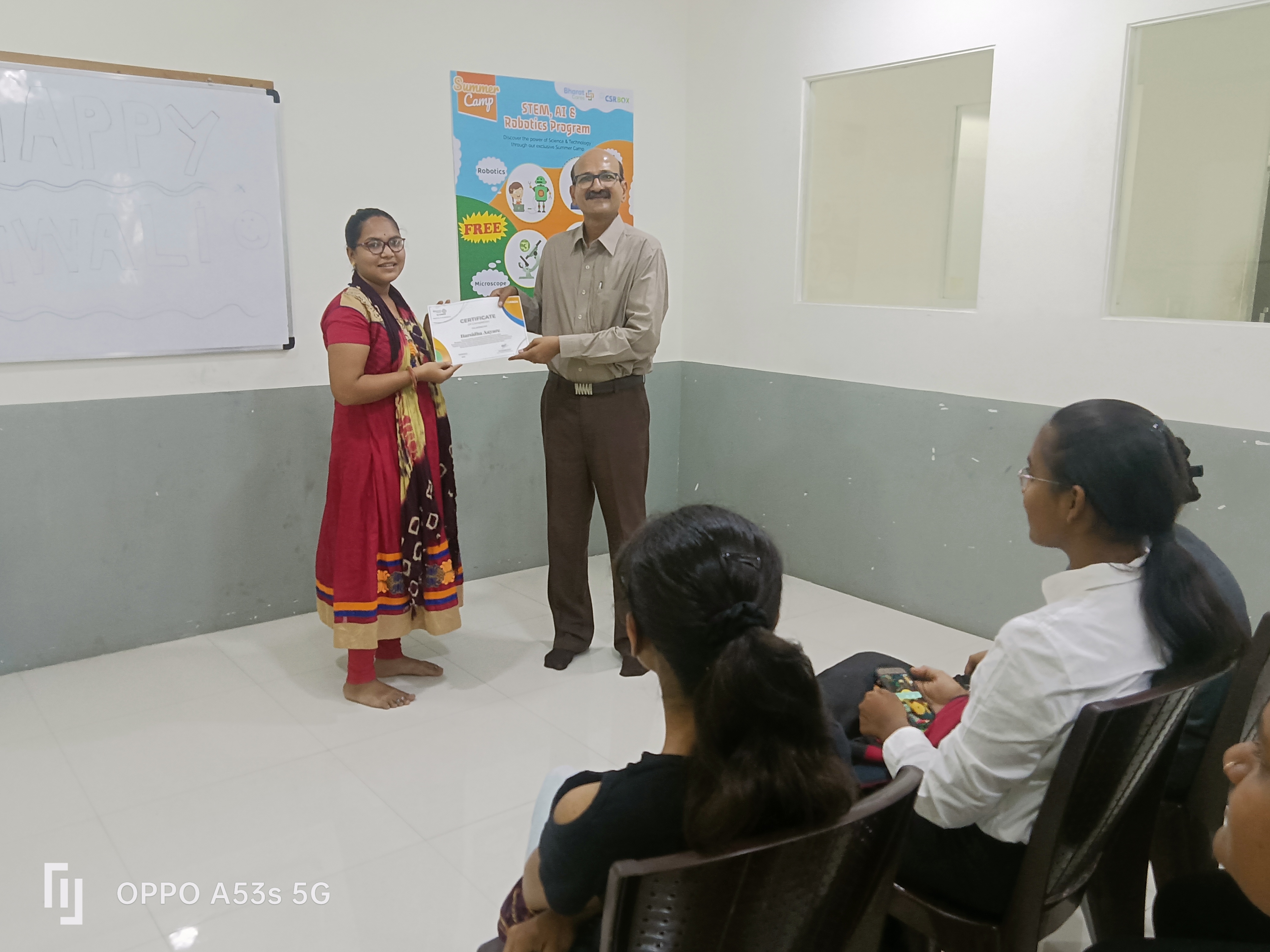

Facilitate employment opportunities by identifying and placing students in esteemed corporate organizations.

Key Features of the Program

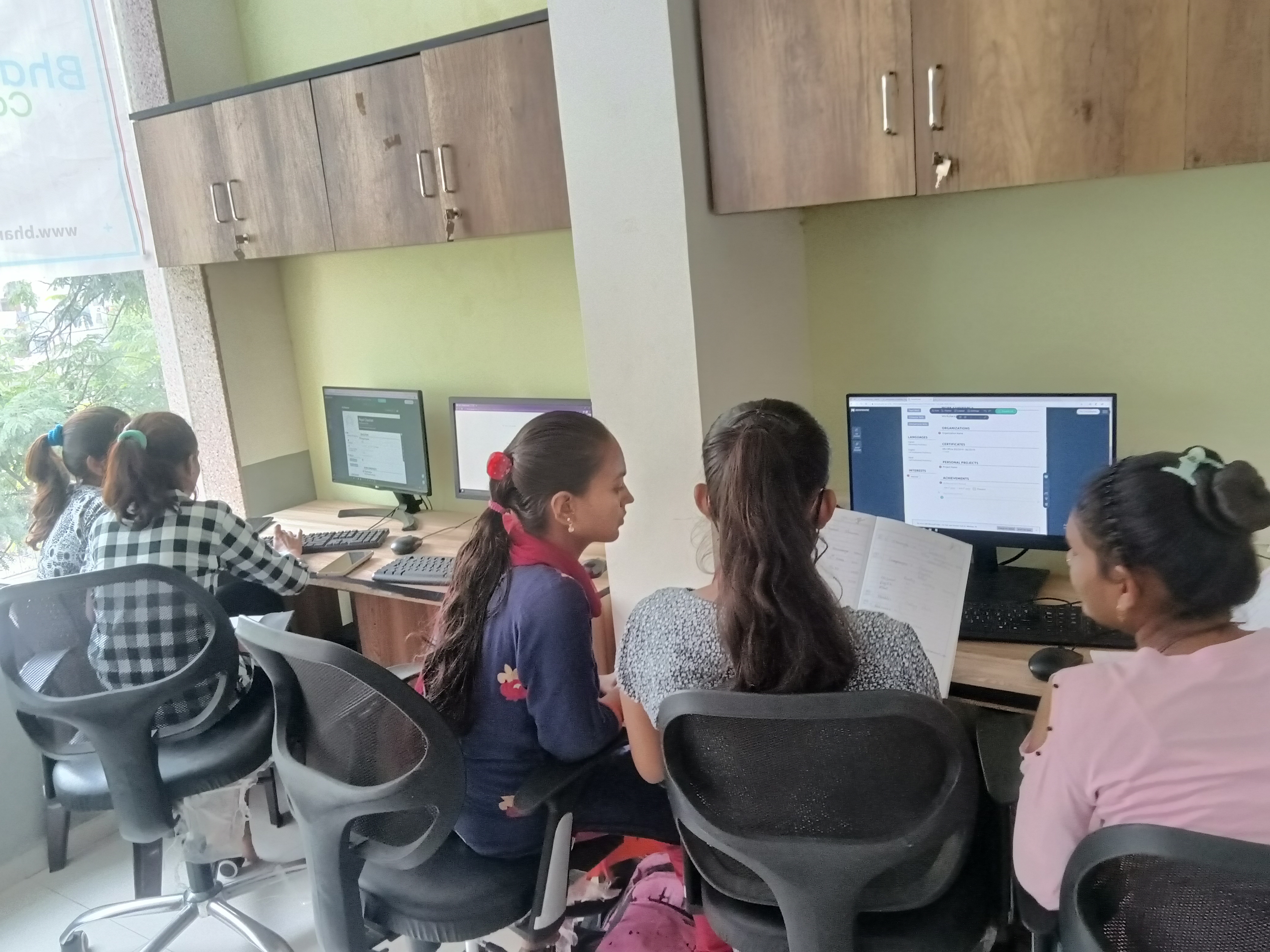

State-of-the-art training facilities.

Industry-aligned curriculum and certification ensuring readiness for BFSI careers.

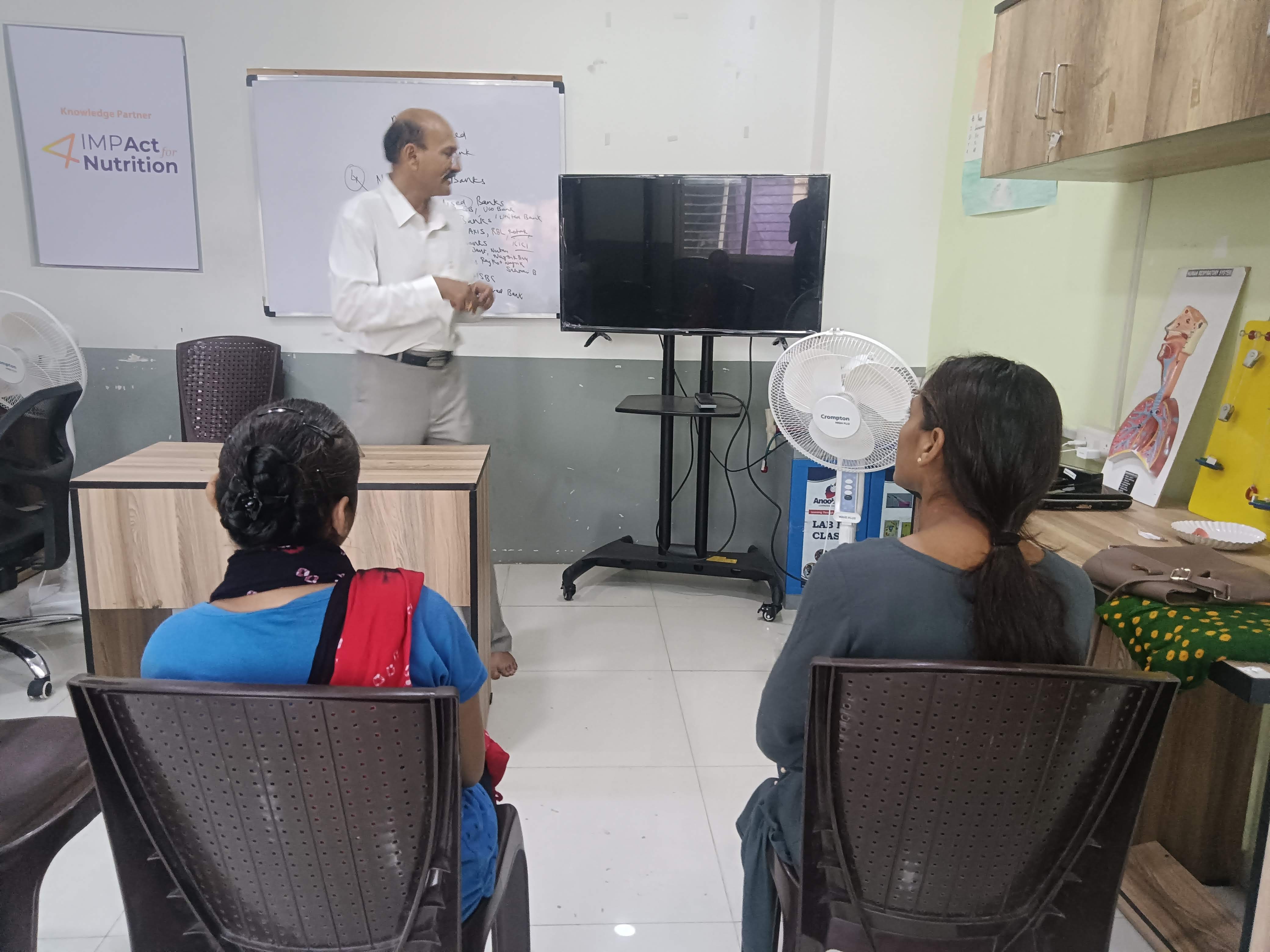

Holistic program offering technical expertise and hands-on training.

Specialized sessions on job readiness encompassing communication, interview, CV writing, and problem-solving skills.

Assessment and certification accredited by NSDC (National Skill Development Corporation).

500

Total Number of Participants / candidates trained

70%

Placement Rate

10,000

We plan to impact around individuals by December 2025

Based on NCFM (National Stock Exchange's Certification in Financial Markets) module on Introduction to Commercial Banking

Overview of Banking Sector Structure in India

Banking Products and Services

RBI's KYC (Know Your Customer) norms and guidelines

Banking Technologies and Platforms

Structure of Insurance Sector in India

Insurance Products and Services

IRDA's (Insurance Regulatory and Development Authority) KYC and Documentation Norms

Insurance Contracts and Legalities

Introduction to Indian Capital Markets

Investment Concepts and Needs

Classification of Investment Products

Customer Acquisition Strategies – Offline/Online

Based on SEBI (Securities and Exchange Board of India) module on Introduction to Mutual Funds

Mutual Fund Structure and Operations

Fund Classification based on Structure and Investment Objective

Risk-Return Dynamics in Mutual Funds

Mutual Fund Investment Procedures

Growth vs Dividend Schemes

Comprehensive Curriculum

Communication, Leadership & Management Skills:

Communication Fundamentals

Effective Listening and Writing Skills

Conflict Resolution Techniques

Leadership and Management Principles

Professional Skills:

Time and Stress Management

Interview Preparation

Career Exploration

Resume Enhancement

Group Discussion Techniques

IT Skills:

Basic MS Office Suite Proficiency

Email Management

Online File Management

Share: